Are You A Salaried Individual Who Cares For Family?

Secure a Rich and Happy Retirement, Fulfill Your Dreams, and Embrace Financial Freedom with the Ease of Technology and Expert Guidance, Tailored Exclusively for Your Success!

Open Your Free “E-Wealth MF” Account In Few Minutes

It’s Simple, 100% Online, Dedicated Distributor

Open Free "E-Wealth MF" Account

* You Will Never Get Spammed - We Protect Your Privacy

l GO PAPERLESS l GO DIGITAL l

l GO PAPERLESS l GO DIGITAL l

What's Your Financial Goal?

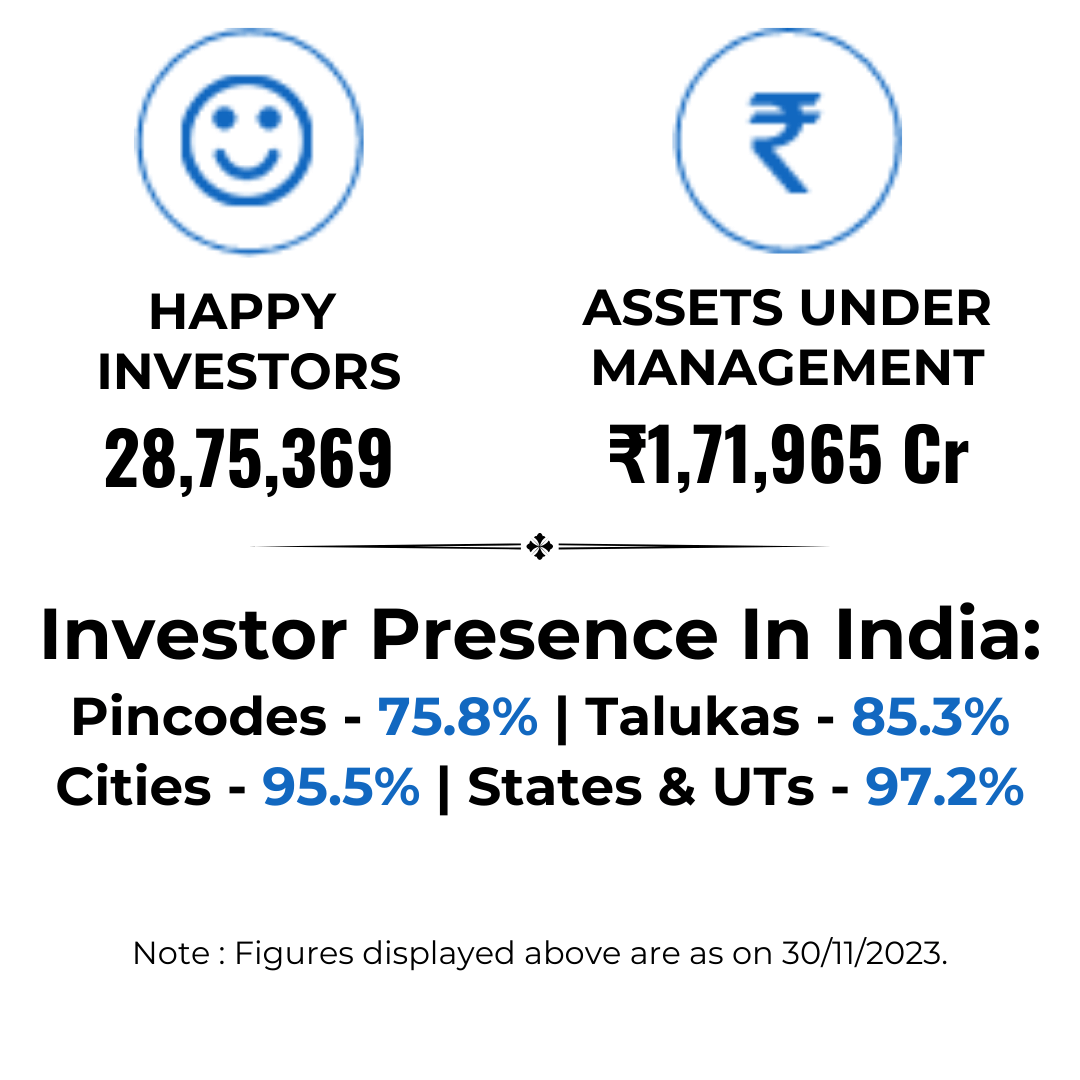

About NJ Wealth

A BUSINESS BUILT ON TRUST

Trust is important for building a healthy relationship. It is also vital in developing new relationships and ensuring that they last. This is true for both personal as well as business relationships, which is why we work hard at building trust with people: including our customers, partners, employees, vendors and communities.

We are BUILT ON TRUST.

ONE PLATFORM FOR ALL YOUR INVESTMENT NEEDS

1

SIMPLE

Your entire financial portfolio neatly organised at one place.

2

100% ONLINE

Experience industry leading paperless transaction features/solutions in one app

3

DEDICATED DISTRIBUTOR

Dedicated mutual fund distributor to guide you in your investment journey.

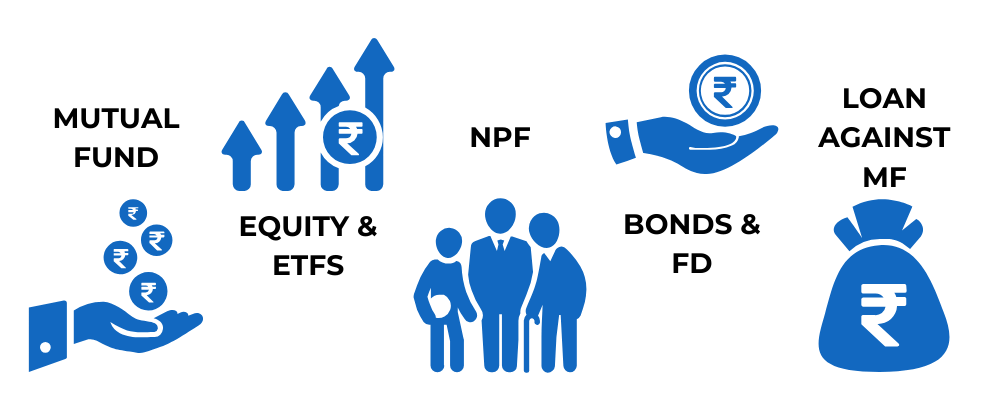

Access a wide range of financial products under one window

Key Features & Services Will Benefit You

Freedom from paper

& Signature

A complete Paperless transactions from the day of opening. No signature ever required for any transactions. Freedom from Signatures.

100% online

No Geographical Barriers, Transact from anywhere using your NJ E-Wealth account

Speed & Accuracy of

Transaction

Transactions happen faster (in minutes) and are more accurate. So there is no queries of corrections.

Multiple Payment Modes

Quick & Easy payment options available, Enabled with Multiple payment options. UPI, NETBANKING, CARD, NEFT/RTGS, NACH

Multiple Bank Registration

Flexibility to add Multiple Banks to single account

Multiple modes of

transaction

Transactions using Call & Transact Facility or SMS or Email or Mobile Application.

Instaa Cash

Earn more than Bank Savings Account by parking your idle money in Instaa Cash. Redemption payout in just few minutes.

National Pension

System (NPS)

Save Additional Tax of R15000 u/s 80CCD (1B) by investing in National Pension System (NPS)

Loan Against Securities

(LAS)

Provision of "Loan Against Securities" facility’ for NJ E-Wealth Account holders. Now Get Loan against your Mutual Funds & Shares.

What Makes NJ E-Wealth MF…

Truly A DIFFERENT!!

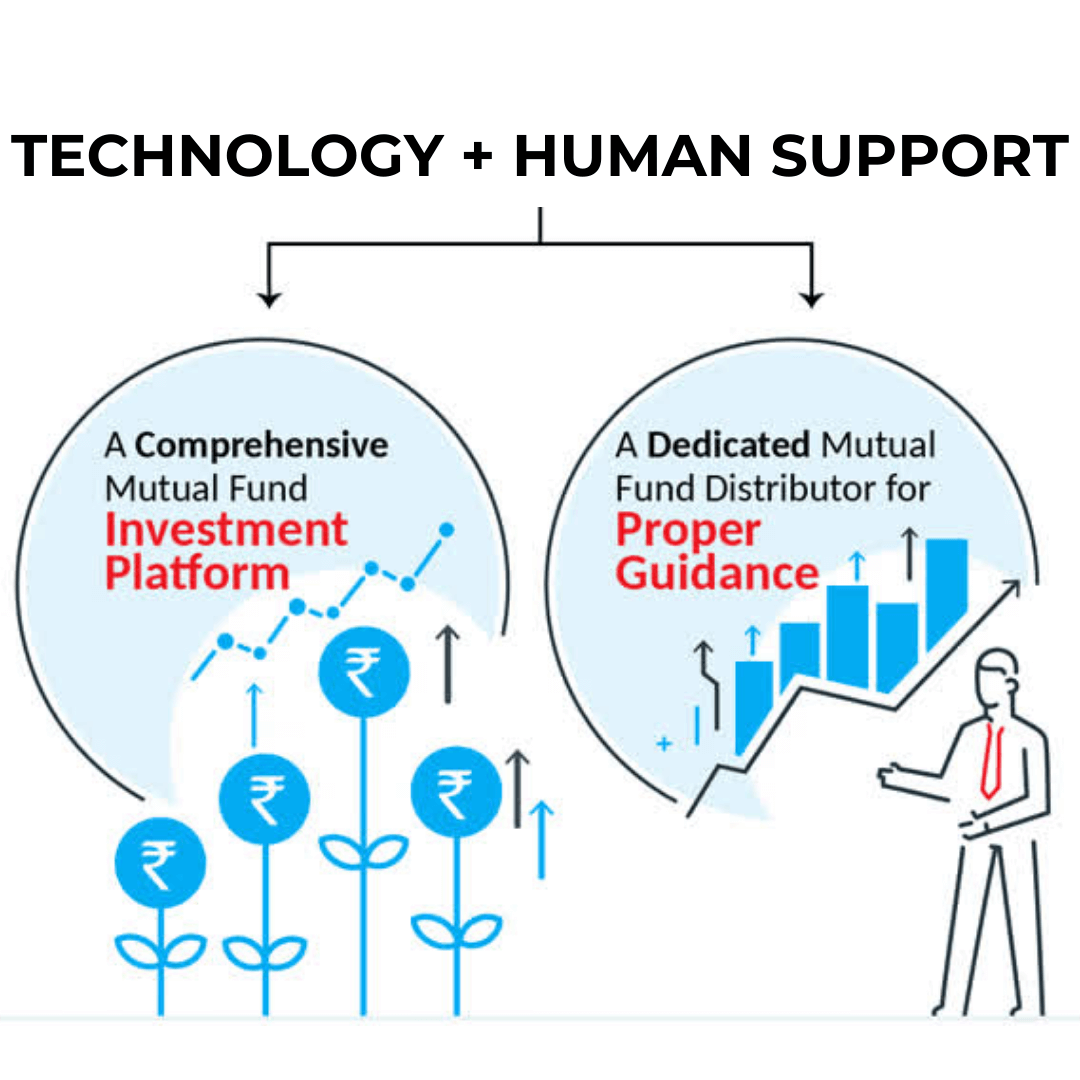

Convenience of Technology & Human Support

Friend-like a professional financial products distributor with you, who will help you achieve your personal / financial goals throughout your life.

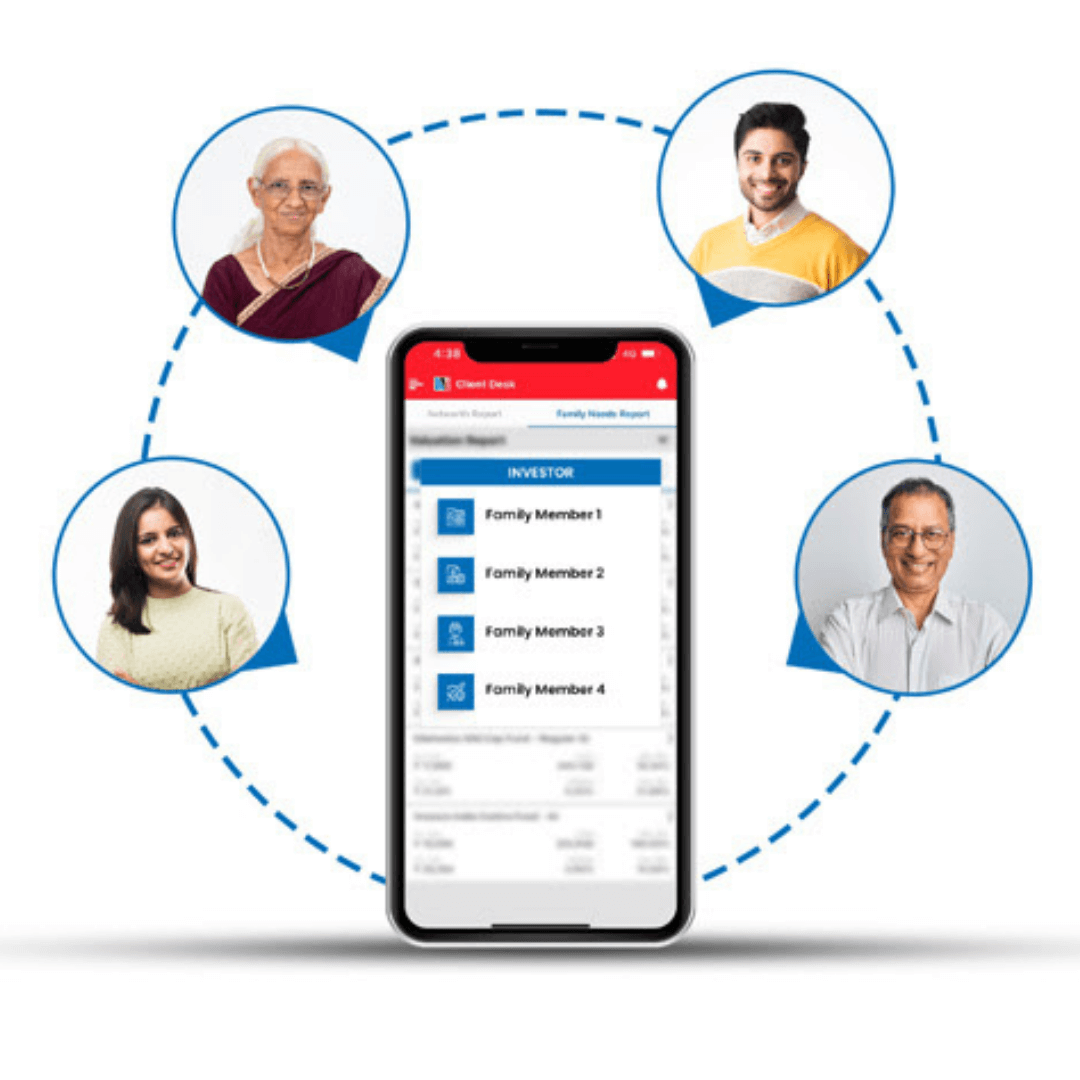

Entire Family Portfolio In A Single Place

One of the important feature of NJ E-wealth account. Now you can view the portfolio of all Family member at one place, Although many families hold their investments in multiple individual accounts, one person usually supervises multiple family portfolios. It is vital for portfolios to be monitored not only at an individual level but also at a family level. It helps in viewing the consolidated portfolio in parent E wealth account.

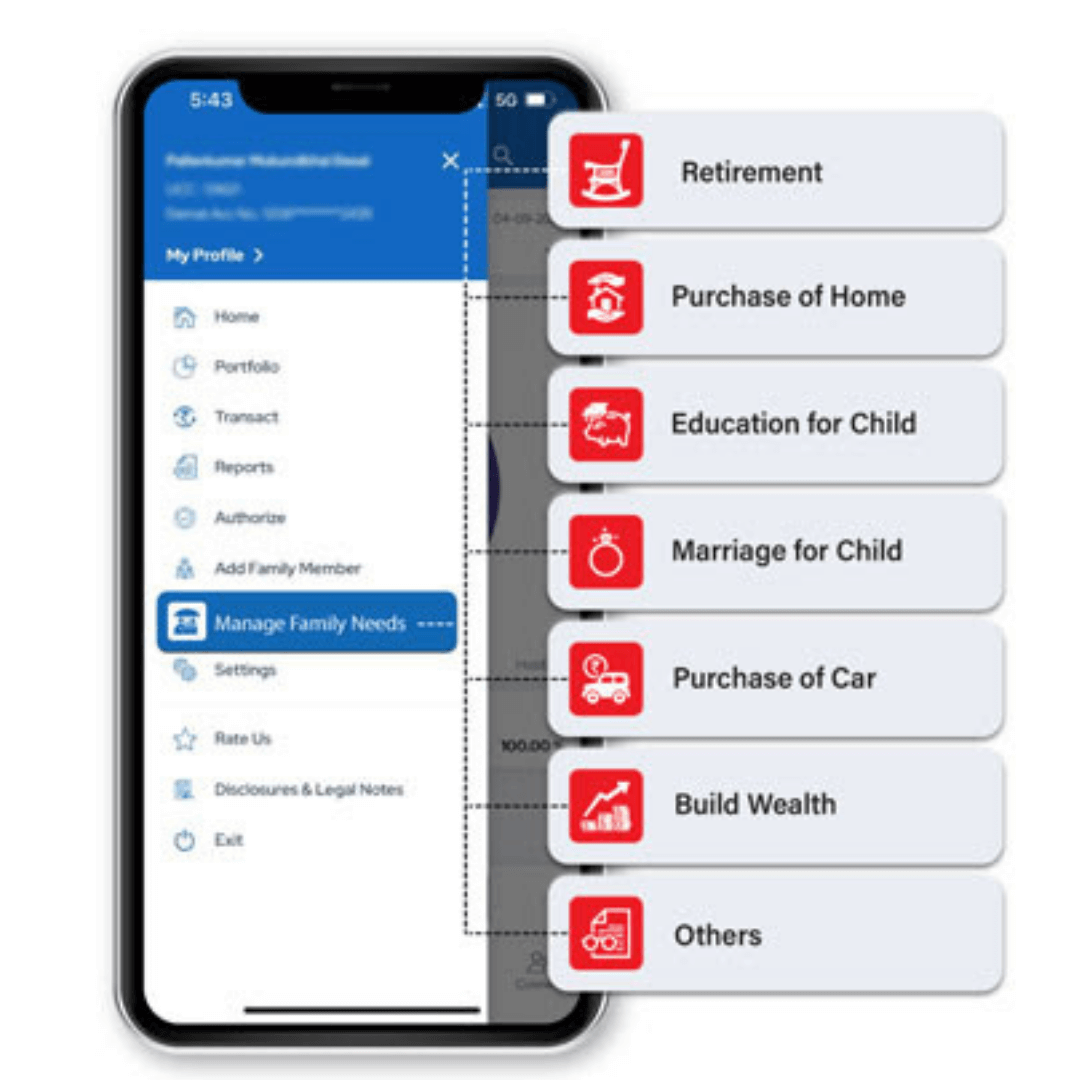

Family Need Utility Tool

Map your mutual fund investment with Family Need Tool and witnessed them getting fulfilled.

You are Just A Message Away

Avail above mentioned services on your fingertips and you are just a message away for any kind of services.

What Clients Have To Say About E-Wealth ?

“My Journey of investments with hand-holding by my NJ Wealth Partner has helped me achieve my financial goals well on time and now, I can say that I have reached a very comfortable position in my life”

- SANDEEP MAHIMKAR

CEO, Mumbai

“NJ has helped me consolidate & easily get whatever info needed on my investments. Amazing to see the kind of details shared, unlike anything I have experienced. My NJ Partner is proving to be a very valuable asset in my life.”

- RAJENDRA KANEGAONKAR

Kolhapur

“True Partners are like diamonds, precious but rare. We are lucky to have our NJ Partner on the NJ platform. They are always perfectly aligned with market pulse, have holistic approach, provide straightforward solutions & deliver unbeaten strategy.”

- PURAV DALAL

Businessman, Surat

“The new NJ E-Wealth Account is just what we needed. The interface is very user friendly & easy to navigate. I am actively using it to track my investments and make transactions. My overall experience with NJ's systems & mobile apps has been excellent.”

- GANESH SHENAI

Professional

“The difference with NJ & others is that NJ has always focused on educating me. Today, after 22 years, I trust NJ completely. I have often seen NJ even acting against their own interests, but certainly, always in my interest.”

- PRAKASH GOLWALA

Businessman

Open Free "E-Wealth MF" Account

* You Will Never Get Spammed - We Protect Your Privacy

FRESH IDEAS, NEW METHODOLOGY

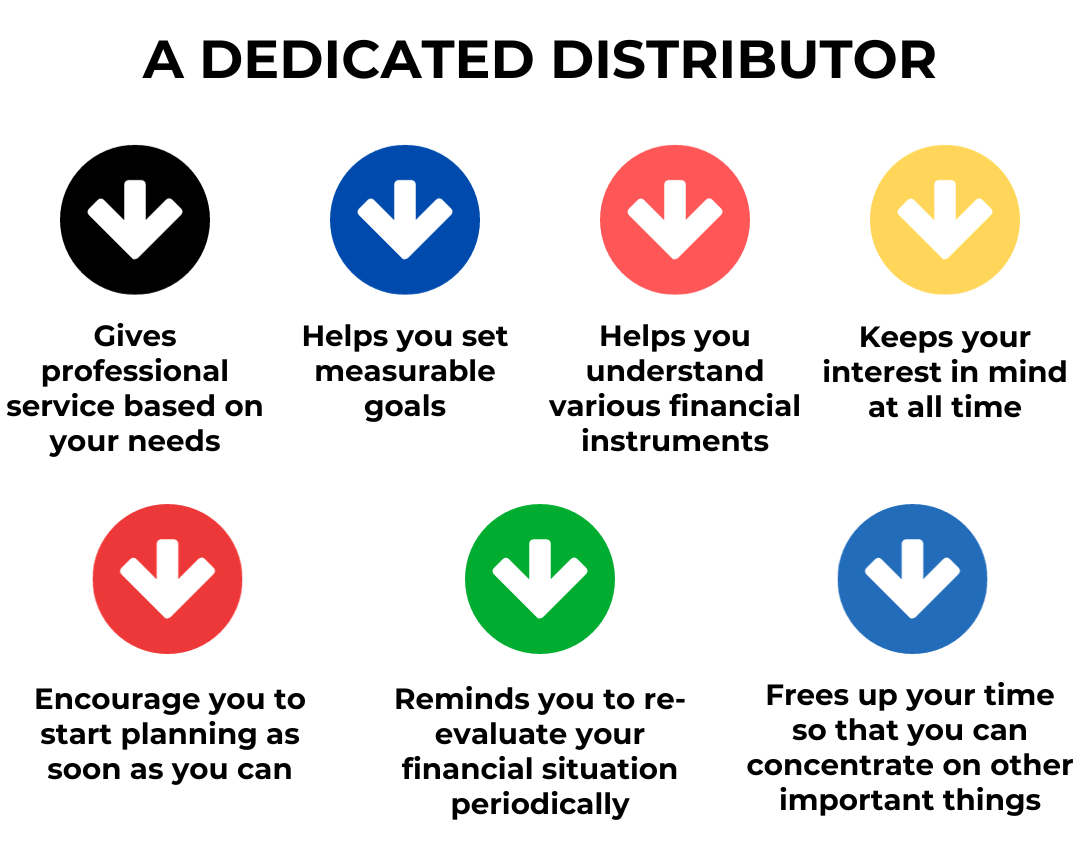

WHY YOU NEED DEDICATED DISTRIBUTOR

About ArthaVision

Mahendra Deshmukh

At ArthaVision, my mission is to help clients in wealth creation and wealth management. I am driven to help my clients with simple, unbiased professional products & services that adds value to their quality of life.

After working for over a decade in the corporate world I made a decision to follow my own path. I became a channel partner of NJ India Invest in March 2019 after receiving AMFI certification for mutual fund business.

At present, I am serving 150+ clients for their personal financial goals. My mission is to assist everyone in wealth creation and wealth management. My approach is to enable clients to have knowledge of investment products so that they make proper progress toward achieving their financial goals in life.

Why should we be your financial product distributors?

Client Centric

Approach

All our services are designed keeping you in mind. Your long-term interests serve as the 'primary' influencing factor in our servicing process.

Value Added

Services

Our services ensure comfort, convenience, confidence and control to you in managing your wealth. You would enjoy being always updated of your investments, any time, anywhere.

Right Experience & Skills

We have over years of experience in financial products distribution space. Our experience, qualifications & skills enable us to understand you and your needs, and then help you to achieve your goals.

Rich Product

Basket

We offer a single point access to multiple financial products with a holistic need-driven approach & not product centric approach.

Driven by

Passion

Serving clients is our passion and the reason why are are in the business. Nothing excites us more that helping our clients achieve their financial goals and dreams in life with our support.

Focus on Customer Satisfaction

We come equipped with the right attitude, people, processes and technology to ensure higher levels of satisfaction and service quality. In transactions, we work systematically to find & ensure quick resolution of any queries or complaints.

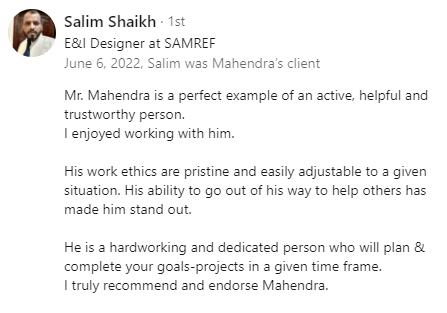

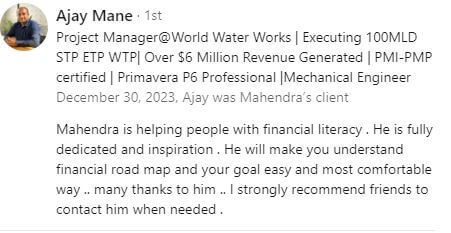

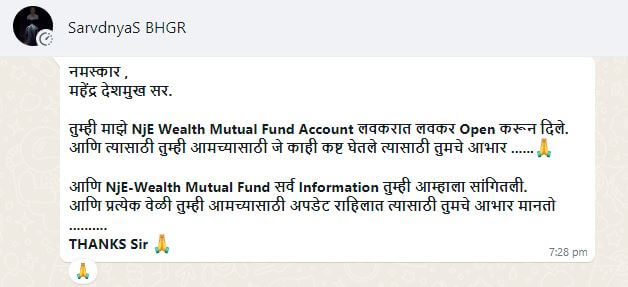

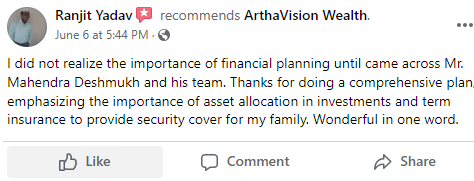

What Clients Are Saying About ArthaVision?

Open Free "E-Wealth MF" Account

* You Will Never Get Spammed - We Protect Your Privacy

Just Think! How many Mondays have been gone since you said, I shall start next week, TAKE ACTION ! START NOW!!

10 REASONS Why you NEED to start your investment journey RIGHT NOW !!

Just like being physically fit, being financially fit can help you lower stress, achieve more & live the lifestyle you want

Every time you delay investing by even a year, you will be making a huge negative impact to the corpus your eventually to build.

Invested amount get automatically deducted from your bank account ensuring discipline in investment

Get the benefit of power of compounding to fulfill your financial goals like Retirement goal, Kids Higher Education & Kids Marriage

Future requirements are huge, the question is How to Handle

To maintain your Family lifestyle and beat inflation

Cost of Higher Education is rising much faster than inflation, Be ready for your child’s Higher Education

At 6% inflation your monthly expenses at the time of retirement after 25 years will increase to Rs. 85,800/Month from current Rs. 20,000/Month

Kids grow up quickly and so do their needs

Time is running, You can’t save time for future use… But you can definitely invest money for future use

Just Think! How many Mondays have been gone since you said, I shall start next week, TAKE ACTION ! START NOW!!

10 REASONS Why you NEED to start your investment journey RIGHT NOW !!

GETTING STARTED IN 4 SIMPLE STEPS!

Getting started with E-Wealth account is very simple and quick

Open a Paperless E-Wealth

Account in just an hour

Share your Name & Mobile No, we will help you with Paperless Free E Wealth Account opening process. It will complete in an hour

Ready For Investment

Once the E-Wealth account is activated you will receive a Password on your registered e mail id by using that you can start investing.

Keep a track of your wealth

You can track all your wealth online anytime & from anywhere from your lap top or simply through a mobile application.

Rebalancing your portfolio

In case you have subscribed to MARS, then you will be receiving suggestions for rebalancing your portfolio twice a year.

EXCLUSIVE BONUSES WORTH 20 K ONLY FOR OUR V.I.P.s

(You Will Regret Missing These Bonuses)

EXCLUSIVE BONUS # 1

Automated Investment Solutions

The most transparent approach to decision making by providing Risk Vs. Return comparison among the shortlisted options.

Get the best Mutual fund portfolios for an investment need.

EXCLUSIVE BONUS # 2

Family Need Utility

Reviewing your goals regularly are equally important. This will help you in reviewing your goals at regular intervals.

EXCLUSIVE BONUS # 3

Portfolio Review Utilities

A Comprehensive Reporting Solution for the Investment Portfolios. A report that covers all major and important details on the investments.

EXCLUSIVE BONUS # 4

Personal Financial Worksheet

With This Tool By Your Side, You Never Need To Think About Paying Thousands Of Rupees For Your Personal Financial Goals

It is the process of meeting your life goals through the proper management of your finances. The way the Personal Financial Worksheet works is fairly simple. The process followed is quite simple, and is focused on various personal financials.

EXCLUSIVE BONUS # 5

Essentials Data File

Be Responsible for your family!!

Financial intelligence is not only about money management. It is also important to keep information accessible.

This worksheet will help you to maintain all the information about you, such as how much you have borrowed, where you have invested, how many bank accounts you have, who you have borrowed or borrowed money from, your family doctor, financial advisor, CA, who they are, what insurance you have taken out and much more.

EXCLUSIVE BONUS # 6

Free Access to Digital Learning Portal

Dive into financial mastery with our exclusive bonus! Gain access to our Online Financial Literacy Course, carefully crafted to empower you with the knowledge and skills for lasting financial success. Let's embark on this educational journey together!

Easy Accessibility, Personal Financial tools that works, Digital Saturday Video, Basic Financial learning Video and many more

Open Free "E-Wealth MF" Account

* You Will Never Get Spammed - We Protect Your Privacy

Your Questions! Our Answers!

What are the documents required for E-Wealth MF account Opening?

Soft copies of PAN Card, Aadhar Card Number, Valid Bank Proof, Signed Specification & basic details like Mobile No, E mail ID.

We will help you in completing your account opening procedure.

Is KYC registration mandatory for E-Wealth MF account opening?

The Securities and Exchange Board of India (SEBI) has made it mandatory for all investors to be KYC-registered (Know Your Client). Hence we necessarily require our customers to be KYC compliant.

In case an investor is not KYC compliant, then we will help for KYC registration along with E-Wealth account opening.

Who can open an E Wealth account?

Below are the list of entities eligible to open an E-Wealth account

Resident Individuals, Non Resident Individuals, Public limited companies

Pvt limited companies, Co operative societies, Registered / Unregistered Trusts, Partnership firms

Can I start investing with NJ E Wealth MF as soon as the account is activated?

Yes, you can start investing as soon as the account gets activated & password will be sent to your registered email id. The investment can be done using NET BANKING using NEFT/RTGS options

Will existing investment automatically be available for future transactions?

Yes, Once the E-Wealth MF account is activated, all investments will be made available for future transactions such as redemption / switch.

What is Instaa cash facility?

Instaa cash is a facility through which you can invest in a liquid fund for better returns compared to a saving account and get the comfort of any time money even on holidays.

What are charges of E Wealth account?

Following 2 options are available with investor

Option 1: "NJ E-Wealth Account" D-mat Account: Annual maintenance charges of NJ E -Wealth D -mat is Rs 354/Year including service tax which will be collected at the anniversary of the account. There are no further charges apart from annual maintenance.

Option 2: "NJ E-Wealth MF Account" Non D-mat Account: NO Annual maintenance charges, It's Free, However you wont be able to transact in Direct equity, Bond and SIP in Equity. All Transaction related to MF & MPS are available on this platform.

Whom to contact if I need support and information?

We (ArthaVision) is your Friend-like a professional financial products distributor with you, who will help you achieve your personal / financial goals throughout your life.

You can reach us through Direct call, WhatsApp message, Email and all other mode of communication. We will share detail hierarchy to reach us once you activate your E-Wealth Account